Whether you want to sail off into the sunset or spend more time with your family, retirement planning is an important step. Choosing low-cost investments, managing expenses, and planning for taxes are steps to ensure your retirement savings last throughout your lifetime.

Budgeting

One of the most important parts of retirement planning is creating a budget that accounts for expected expenses during retirement. You start by separating your current spending into two categories: mandatory fees (your “needs”) and discretionary spending (your “wants and wishes”). Some expenses will remain relatively stable, such as your housing costs, utilities and debt payments, while others may fluctuate monthly, such as entertainment or food expenses. It would help if you also considered whether you will have any major upcoming expenses, such as buying a new car or taking an exotic vacation. And finally, it would be beneficial to consider how much you should save for retirement.

Investments

Many retirees depend on a combination of sources of income in retirement. You can estimate your prospective retirement income from sources including Social Security, pensions, employer-sponsored retirement plans like 401(k) accounts, and individual assets with the aid of a financial expert. A retirement planning Wyckoff NJ advisor can also help you choose the right investment strategies to reach retirement goals. For instance, many financial professionals advise switching to a more conservative asset mix as you get closer to retirement, with a higher proportion of bonds and cash. In addition, an advisor can review your debt levels and develop strategies to reduce them. They can also help you determine how much you should save for retirement by calculating the amount of money you will need to replace your pre-retirement income in retirement, factoring in factors such as expenses that may change and inflation. For example, if you want to purchase a new home or fund your children’s education after retirement, these costs must be incorporated into your budget.

Taxes

Depending on your situation, retirement taxes can significantly impact your retirement income. Your “paycheck” in retirement will likely come from various sources, and it’s up to you to ensure proper taxes are paid appropriately.

One way to manage your retirement taxes is by maximizing tax-deferred accounts like 401(k)s and traditional IRAs. While profits are taxed when withdrawn in retirement, these accounts allow you to lower your taxable income dollar for dollar in the year you contribute. Other ways to manage your retirement taxes include minimizing debt and cutting expenses. This can be accomplished by developing strategies in a new window to pay off high-interest debt and adjusting your lifestyle to reduce non-revenue-generating spending. Finally, you can plan for healthcare expenses and long-term care by understanding Medicare and supplemental coverage options. And you can secure your estate by establishing trusts and creating power of attorney documents.

Social Security

If you want to be able to retire at whatever age you decide, you’ll need a lot of money. Your financial advisor can assist you in creating attainable savings objectives and will work with you to create a strategy to achieve them.

For example, if you’re close to retirement, it’s a good idea to continue to max out your employer’s matching 401(k) contributions and to open and contribute to a traditional or Roth individual retirement account (IRA).

It’s also important to pay down debt as you approach retirement and consider long-term care insurance. But most of all, it’s important to remember that Social Security can replace only about 40 percent of your pre-retirement income. That’s why saving and investing your funds is so important. An advisor can help you get started, stay on track and make the most of your hard-earned retirement dollars.

More Stories

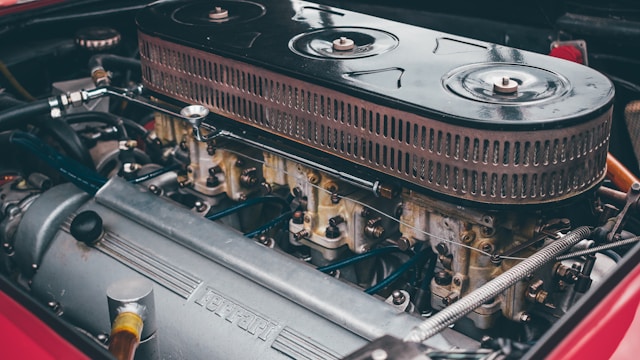

How Barrel Air Cleaners Improve Engine Performance: A Comprehensive Guide

Guarding Your Haven: The Essential Role of Regular Roof Inspections in Home Maintenance

Key to Success: How Online Piano Classes Can Transform Your Skills