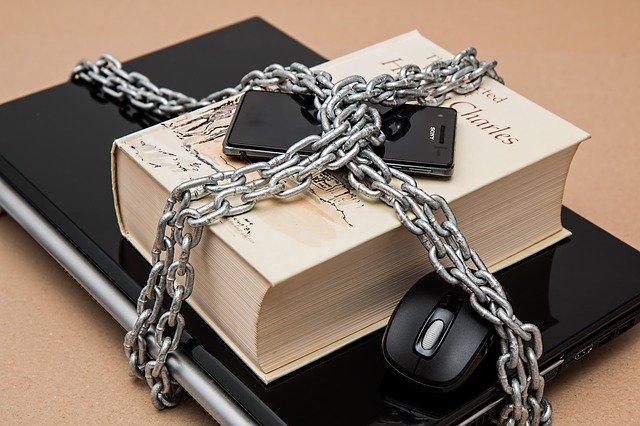

No one likes to think about the likelihood that employees will steal from their business, but it’s a fact of life that some people act dishonestly in the workplace. Sometimes that comes in the form of manipulative behavior, other times its outright theft. Solid hiring processes can help you identify risk factors and hire the most honest candidates, but that is not a guarantee you have prevented theft, just a way of mitigating its likelihood. That’s why businesses who trust employees to handle money or payments on behalf of the company often carry an employee dishonesty bond.

What Does a Dishonesty Bond Cover?

When you take out this type of bond, it covers employee theft and embezzlement in general, up to an agreed-upon policy limit. Depending on the provider, certain kinds of financial malfeasance might be excluded. The goal is to protect your company’s finances, so when you make a claim and the bond provider verifies it, you are reimbursed for the stolen funds. This may require a review process. For bonds that protect your clients from dishonest actions on your employees’ part, you will likely need a separate, specially tailored bond that reflects your business model. There is a big difference between the actuarial table for a bond that covers employees working at a client’s business and the ones covering employees with fiduciary obligations to clients, for example, and both differ from standard employee fidelity bonds.

Bonding vs. Theft Insurance

Some businesses opt to handle the chance of employee theft or embezzlement through an insurance policy instead of a bond. Others combine the two in various ways to get the coverage they need. When it comes down to it, the question you should ask is whether the bond will save you money over opting for insurance coverage only. In many cases, the answer is yes, and that makes the best choice for your bottom line very clear. It’s also worth considering the exclusions in both insurance quotes and bond quotes to assess whether one can be used to cover gap risk.

How To Find Fidelity Bond Providers

It’s as simple as looking for the companies that provide you with the resources you need to understand how their product works for your business. Some providers focus on specific industries, like finance or retail. Others provide theft and dishonesty bonds broadly, crafting them to the specific needs of each customer’s industry. Either way, the key is to find a company with expertise in this specific class of bond, so you can be sure your investment covers all the risks you could face on this front.

More Stories

How Packaging and Design Solutions Can Enhance Product Visibility

The Cost-Effective Way to Boost Your Website’s SEO With Outsourcing Link Building

The Importance of Signages in your Daily Life