There are many reasons you look for the fastest way to sell your house or buy your home in today’s world. Refinancing, downsizing, Millennials, mortgage rates, and neighborhood changes are just a few reasons people buy or sell homes. There are also many benefits to selling your house.

Refinancing

Refinancing is a great way to get better interest rates and reduce monthly payments. It can also help you eliminate high-interest debt. But it can also be a costly process. Closing costs are typically 2% to 5% of the value of your home. Ultimately, depending on your financial circumstances and needs, it would help if you decided on your refinancing option.

Refinancing can save you thousands of dollars in interest payments. You can use the money to pay down debts, get rid of private mortgage insurance, and lower your mortgage payments. It can also be a great way to change from an adjustable rate to a fixed-rate mortgage.

While you may want to sell your house after refinancing, you must consider your financial situation carefully. If you have too much negative equity in your home, wait until the real estate market is better before selling it.

Downsizing

There are many reasons to downsize, from changing lifestyles to changing finances. You may have been financially successful when you first bought your home, but now you have kids that have moved out, or you may be heading into retirement and want a smaller house that’s more manageable.

Downsizing can greatly lower property taxes and mortgage payments and free up cash for retirement. In addition, it can free up unused space and make it easier to manage. You don’t have to worry about financing another home; you can use the money to help pay for day-to-day living expenses or travel during your retirement.

There are many reasons to downsize, and the process can be complicated. There are many decisions and factors to consider, including taxes, interest rates, and emotional decisions about people and things. If you have not planned properly, you may feel overwhelmed and confused. But professionals like those at TheMLSonline can help guide you through those decisions so you make the best choice possible for your situation.

Millennials

The millennial generation is different from the previous generation regarding housing preferences. For starters, they earn less than their predecessors and often spend all of their money on a down payment, leaving little room for upgrades. In addition, millennials want a large yard and a place to bring their pets. They also like the convenience of technology.

Millennials are more likely to live with their parents than any other generation. According to a Pew Research study, nearly half of 18-34 year-olds live with their parents. Despite this, millennials are still buying homes in greater numbers than any previous generation, and this demographic is considered the fastest-growing homebuyers segment.

To make your house more attractive to millennials, try to tailor your marketing strategy to their preferences. Millennials like to buy homes near their workplace and prefer properties under $350,000. As a result, you should focus on building your referral business and launching a Renter-to-Homeowner program.

Mortgage rates

If you’re considering selling your house, you may be surprised to learn that current mortgage rates are meager. Homeowners can lock in rates below 4% if they want to. Many current homeowners have enjoyed this low rate, which makes selling their homes much more affordable. However, as interest rates rise, sellers may need help selling their property because they’re unable to lower their rates. If this is your case, you may consider refinancing, which can offer you lower monthly payments.

Mortgage rates are an essential part of the home-buying process. Rising interest rates can make the process of buying a house very stressful. But with a little preparation and knowledge, you can ease the anxiety of the housing market by obtaining a lower interest rate.

The federal funds rate is a benchmark interest rate that the Federal Reserve Bank sets. It is the interest rate that banks pay when they borrow money and the interest rate that all other lenders use. Mortgage rates are based on various factors, including the buyer’s economy and financial state. When the economy is doing well, mortgage rates are generally higher. This is because more people have more money to spend on housing, and the demand for homes rises, driving the interest rate.

More Stories

Say Cheers to Time Saved: How Alcohol Delivery Services Make Your Life Easier

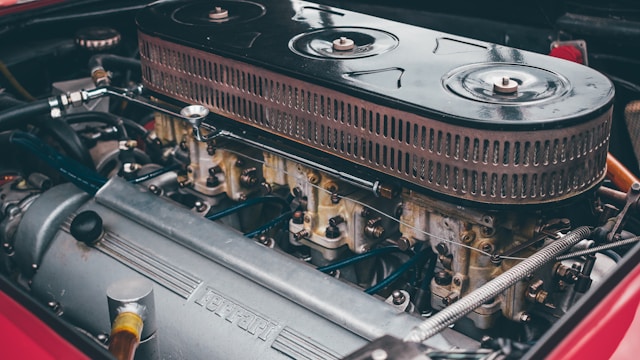

How Barrel Air Cleaners Improve Engine Performance: A Comprehensive Guide

Guarding Your Haven: The Essential Role of Regular Roof Inspections in Home Maintenance